The Best Online Loan System

An extended platform for delivering the complete range of financial services needed for an effective financial inclusion solution.

We started with the ambition to bring banking and financial services technology into the digital-first world and to make it accessible for all. Dreaming big but wisely, Our Software began with servicing microfinance institutions and fintech startups. Within two years our engine was adopted by 100+ microfinance organisations, in 26 countries worldwide.

Our Software exists to empower our customers to deliver great modern financial experiences easily to everyone around the world. Who are these people that we want to empower? They are the developers, the architects, the business analysts, the innovators of our customers. They work with our platform, our teams, and our services to create great outcomes for their millions of customers - be they entrepreneurs in NYC, farmers in Kenya or SMEs in Brazil. Today our customer list includes fintech start-ups, telcos and top tier banks. We operate on six continents and help customers constantly change the way financial institutions operate and innovate. As the industry leader in banking and fintech software, we are taking on the $250B market of banking technology worldwide, and service more than 200 customers with over 65M end users.

Want to start a digital lending business? Offer a new loan product, or transition your legacy loan management to digital-first?

Want to build a bank from scratch? Move an existing deposits offering to digital-first? Replace your old core banking system entirely?

Say hello to Our #1 Best banking platform powering loans for hundreds of financial providers worldwide.

Our Software gives you a native lending engine, comprehensive toolkit and connected ecosystem that enables banks, fintechs, retailers, corporates and others to build a variety of loan offerings tailored to your customer’s needs. From embedded finance and mortgages to SME lending and purchase financing. Whatever your lending goal, Our Software gets you there faster, at less effort and cost.

Our Software is a native, API-driven banking and financial services platform. It is designed to power financial innovation, to bring solutions to market faster, drive down cost barriers and allow ecosystems to expand. Everything that we need is available, all APIs are already there and it is easy to do integrations

Our vision

Most people would agree that financial services are sometimes frustrating. Cumbersome, often manual, difficult to understand and not tailored to individual needs. Technology has a big role to play in improving that experience. With Our Software, we aim to provide a platform for anyone who wants to create better financial experiences. We work across a range of domains from personal lending, business lending, mortgages, trade finance, digital wallets, currents accounts and many more - and will continue to expand to be able to service any financial service that can or will be built anywhere in the world.

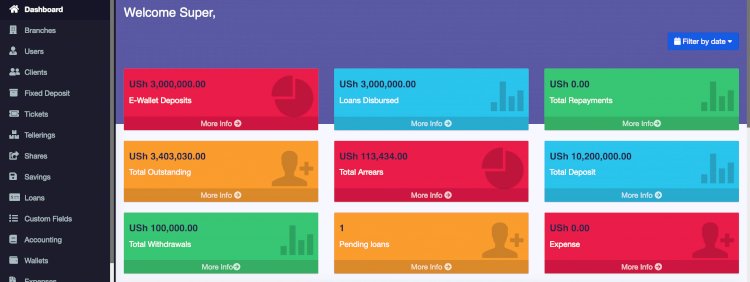

Sakoly is an extended platform for delivering the complete range of financial services needed for an effective financial inclusion solution. It contains the web platform, and mobile apps(Android & iOS). It can be deployed in any environment: cloud or on-premise, mobile; it’s extensible enough to support any organizational type or delivery channel and flexible enough to support any product, service or methodology. For any organization, big or small, it will provide the Branches Management, User/Staff Management, Client/Customer Data, Loan,Fixed Deposit & Savings Portfolio, Shares/Investment, Assets, HRM Management, Tickets & Support, Tellering, Wallets, Income & Expense, Project Management, Spreadsheet(Excel) Management, Client/Customer Portal, SMS & Email Notifications, Accounting & Journals With 100+ Reports, Payment Gateways Intergrated (M-pesa, Airtel Money, Equity/Equitel, Pesapal, Flutterwave, Paystack, Paypal, Stripe,), REST API's, And More Ready Features.

Loans… we can’t seem to do away with them! Money is a scarce resource and we need it in our day-to-day activities. Let’s talk about an online loan system.

Well, loans are expenses and also a source of income. When you get into the loan business you need to be ready.

The loan business involves lending and management of many other assets. It also involves creating a good credit score.

One also needs to have a way to check on clients, credit scores, and many loan terms. It is crucial to keep the business professional.

Besides, we are digital! Everything is now turning online; from websites, money transactions, businesses, and many others.

What is a loan?

This is the money or assets we assign to an individual for a duration and we expect it back with an extra amount (interest).

It can also be something we give for something else; giving a computer to a theatre to manage their records.

Well, an individual can loan a company or other individuals or vice versa!

What is a loan system?

It’s a software system that automates the loan process. It offers an efficient easily configurable module for all loans.

It eliminates the workload and offers to assist in transactions. Besides, it also keeps safe details of all transactions and clients’ data.

They also provide records and statements as well as manage interest rates.

Why use a loan system?

Ease the process of lending

As stated the loan system automates the process of lending. It creates a workload-free environment to ease the lending process.

Every client deserves a fast, hassle-free environment. This is to help them transact fast and easily.

A transaction-free and secure; automated loan disbursal, credit checks, and many other workload-free tasks.

Creates paperless transactions

Papers take time to sign, sometimes also they may be displaced. This process is risky and also makes record keeping a bit hard.

The loan system however removes the paper transactions; with just a click of a button, one can access funds fast.

Besides, the records are safely backed up and are easy to access, no more going to the filing cabinet; safe from fire and other related calamities.

Improved security

Files are safely stored in a server instead of traditional filing systems. Also, the files are accessible with the correct credentials.

It also increases portability; one can access it from anywhere with the correct credentials and a good internet connection.

No need to worry about disaster, theft, and calamities destroying your files. It’s easy to share with the client easily whenever there are issues.

Superior customer experience

Everyone deserves a fast, easy, and hassle-free loan assessment. Loans at times are needed as an emergency and a loan system will automate all these.

Customers need not sign anything; they just accept the terms and conditions by clicking a button and funds come in.

This also promotes your brand, it also gives the customer a way to reach out to others and keeps them coming back.

Where to get a loan System?

There are many loan systems available for banks, unions, and many other lendings institutions. However, here is one of the best!

Best? Yes… Why?

- Provides statements and business reports on all transactions made.

- It is fast and easy to use.

- It is very affordable.

So what’s this online loan system?

Introducing Sakoly: An online software for bankers, credit unions, lending organizations, and many other financial institutions.

Sakoly is used to manage the clients’ information, keep track of their transactions and generate reports and business statements.

Sakoly has been up and running for over 6 years and serving thousands of institutions both local and international.

Sakoly Core Banking System has successfully integrated with:

- Banks

- Mpesa

- PesaLink

- Credit Reference Bureaus (CRBs)

- Vodacom

- Tigo

- Among others

Why Sakoly?

- Affordable– for as low as $20, manage all your clients’ transactions and keep their data safe all in one platform.

- User-friendly- as an all-in-one platform, it is easy to navigate and access different clients without hassle.

- Payment modules- clients are not limited to only one payment module, Sakoly is integrated with many payment modules.

- Easy to know how the business is doing- rich reporting and business analytic tools available for use.

- Reports and business statements- Sakoly provides reports on all transactions made and provides statements too.

Sakoly is the best online loan system. It offers a lot as a web-based software; besides, it’s easy to use.

It helps eliminate the workload by automating transactions. Besides, it provides a paperless transaction method that is safe.

Get the online loan system and ease of the work!

FOR BUSINESS PURPOSES REACH US ON WHATSAPP ON +254714643906 or Email: geeksourcecodes@gmail.com or business@elitepathsoftware.com or info@sakoly.com

DEMO ONE(ADVANCED VERSION)

Admin Url: https://sandbox.sakoly.com/

Admin Credentials

Email:admin

Password:123456

Client Credentials

Email:client

Password:123456